Deterministic Finance.

Eliminate "hallucination risk" in automated financial workflows. Akios provides the mathematical scaffolding to run autonomous agents in high-frequency trading, fraud detection, and banking.

Institutional Grade

Financial institutions cannot afford "probabilistic" errors. Akios provides the deterministic scaffolding required to satisfy regulators and risk committees.

Unhandled Exceptions

Transaction Traceability

Policy Check Latency

import { Agent, Context, Tool } from '@akios/sdk';

// Define hard risk limits

const RISK_POLICY = {

maxTransaction: 10000.00,

authorizedCurrencies: ['USD', 'EUR'],

requireApprovalAbove: 5000.00

};

export const tradeExecutor = new Tool({

name: 'execute_trade',

description: 'Executes a market order',

parameters: z.object({

amount: z.number(),

currency: z.string(),

side: z.enum(['buy', 'sell'])

}),

// Pre-execution hook (Deterministic)

middleware: async (ctx, args) => {

if (args.amount > RISK_POLICY.maxTransaction) {

throw new Error('RISK_VIOLATION: Amount exceeds hard limit');

}

if (!RISK_POLICY.authorizedCurrencies.includes(args.currency)) {

throw new Error('COMPLIANCE_VIOLATION: Unauthorized currency');

}

// Log intent to immutable ledger before execution

await ctx.ledger.recordIntent(args);

}

});Thought as a Transaction.

In Akios, an agent's reasoning step is treated with the same rigor as a financial transaction. We cryptographically hash the "Thought → Plan → Action" loop, creating an immutable audit trail.

- Regulatory Circuit Breakers: Hard-coded policy layers that sit outside the LLM context window. The model cannot hallucinate its way past a compliance check.

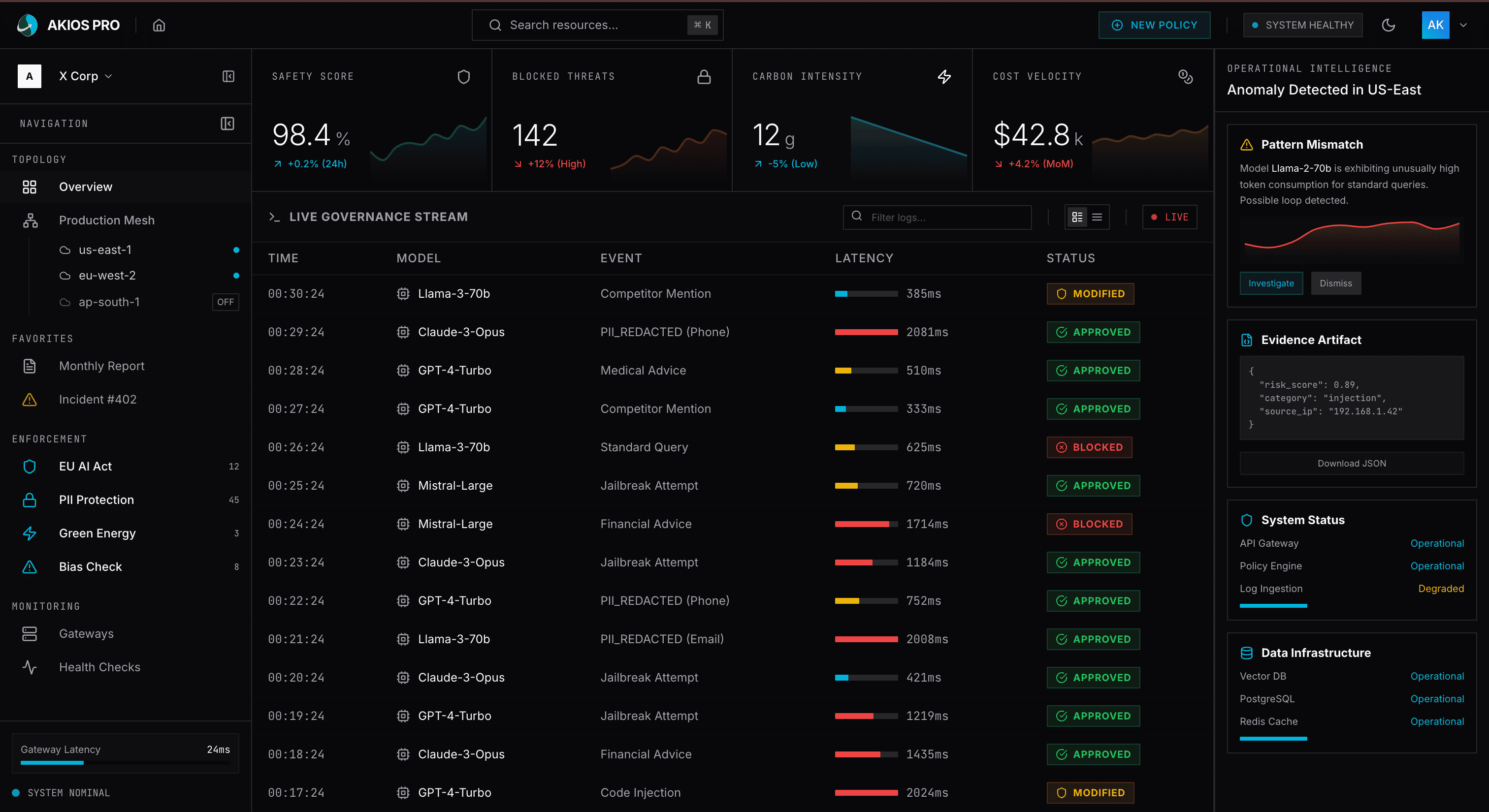

- Observer Pattern: "Shadow Agents" monitor the primary agent's reasoning in real-time, flagging anomalies before execution.

- Ledger Replay: Reconstruct any past decision state bit-for-bit to satisfy regulatory inquiries or debug incidents.

The Akios Ledger

Turn agent cognition into a committed transaction log. We treat "thought" as a financial instrument that can be audited, replayed, and verified.

Regulatory Circuit Breakers

Define hard constraints (e.g., "Max trade size $10k", "No external emails"). If an agent attempts to violate a policy, the runtime halts execution instantly.

Deterministic Replay

Debug production incidents by replaying the exact state of the agent's memory and context at the moment of decision. Root cause analysis in minutes, not days.

Real-Time Fraud Hooks

Inject custom fraud detection models into the agent's control loop. Every tool call is scored for risk before execution is permitted.

Technical Specifications

The Akios Financial Engine provides the deterministic guarantees required for algorithmic trading and automated banking operations.

Risk & Governance

- Policy Latency

- < 1msPre-flight check overhead

- Circuit Breakers

- Hard-StopAtomic transaction rollback on violation

- Currency Support

- ISO 4217Native multi-currency awareness

Ledger & Audit

- Immutability

- WORM StorageWrite-Once-Read-Many (SEC 17a-4)

- Precision

- NanosecondNTP synchronized timestamps

- Format

- Parquet / AvroHigh-throughput analytical schemas

Performance

- Throughput

- 10k TPSTransactions per second per shard

- Uptime

- 99.999%Active-Active Multi-Region

- Replay Speed

- 100x RealtimeAccelerated historical simulation

Automate with confidence.

See how leading fintechs are using Akios to deploy safe autonomous agents.